Invest in innovative UK start-ups

Our SEIS Fund invests in innovative and disruptive early stage businesses supporting them on their journey. Our EIS provides follow-on capital to fully exploit commercialisation of a proven business model.

Join a growing community of over 650 investors.

Why Jenson?

11 exits to date, highest ratio of exits per number of investments across SEIS funds.*

12 year track record with 100% qualifying deployment.

£266m of enterprise value across over 75 active start-ups in our portfolio.

£300m of external funding overall in Jenson backed companies.

£6m follow-on funding to 36 of our portfolio companies via our EIS Fund

Capacity to deploy – repeatable tranches of deployment with an average full deployment timeframe of three months from investment.

Post investment support for our Portfolio companies and Investors

*Tax relief depends on an individuals circumstances and is liable to change.

**Past Performance is not a reliable indicator of future performance.

Tax benefits

Tax relief depends on an individuals circumstances and is liable to change.

Income Tax Relief

50% for SEIS and 30% for EIS upfront income tax relief which may be claimed for investments

Capital Gains Tax (CGT) Reliefs

50% exemption from capital gains tax for SEIS and tax deferral may be available for EIS

Loss relief

Loss relief may be available to investors at their marginal tax rate

Our Investment

Process

Request an Application Pack

Receive and Complete the Application Form

Financial Intermediary & AML Certificate/Investor & AML Certificate

Strategy &

Performance

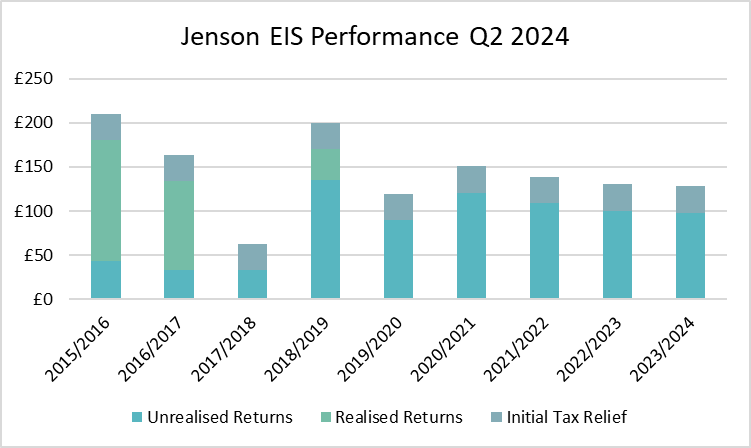

EIS

The Jenson EIS Fund has a mandate to focus on long-term capital growth and enables private investors to invest in a range of committed and ambitious entrepreneurs and their early stage growing companies. The Jenson EIS Fund predominantly facilitates syndicated follow-on funding to its existing portfolio, external opportunities are also considered allowing us to benchmark against our existing opportunities. To date our EIS Fund has:

- Provided over £6m follow-on funding to 36 of our portfolio companies;

- 1 exit providing returns ranging from 2x to 4x across 5 EIS tranches; and

- £300 million of external funding provided to Jenson backed companies.

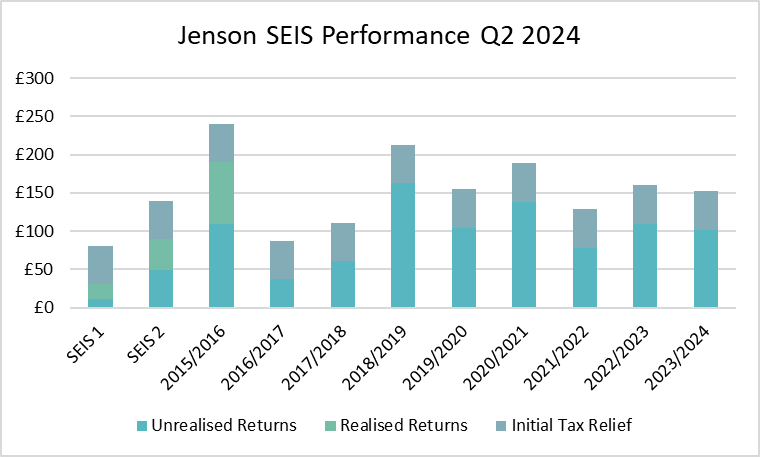

SEIS

The Jenson SEIS Fund aims to target new innovative companies which are developing disruptive technologies with established plans and management teams, demonstrated growth potential with strong commercial opportunities with a planned exit strategy. The Fund is a generalist fund with a focus on tech enabled businesses, thereby the sector focus is agnostic, typically small early stage companies in non-capital intensive sectors.

To date our SEIS Fund has:

- Made over 140 investments;

- £266 million enterprise value of the 70+ start-ups that are currently still active in our portfolio; and

- 11 exits with Average exit multiple of 4.69x and our highest exit multiple at 12x for 2023.

*Performance is based on the combination of realised and unrealised value. Investments are illiquid until any of the underlying Investee Companies are sold or float on a stock market. Past Performance is not a reliable indicator of future performance. As at 5 April 2024.

Frequently asked questions

What kind of companies will the Fund invest in?

SEIS

The SEIS Fund aims to target exciting new innovative and disruptive technologies on a sector agnostic basis to be nurtured alongside existing investment opportunities that require follow on investment, via the EIS, to fully exploit commercialization of a proven business model. The fund has a mandate to focus on long-term capital growth and enables private investors to invest in a range of committed and ambitious entrepreneurs and their early stage growing companies. All companies will be small unquoted UK companies which have been trading for less than two years that qualify under the SEIS tax rules. The fund is a generalist fund focussing on tech enabled businesses. The type of businesses and opportunities will be SEIS compliant (typically small early stage companies in non-capital intensive sectors).

EIS

The EIS Fund has a mandate to focus on long-term capital growth and enables private investors to invest in a range of committed and ambitious entrepreneurs and their early stage growing companies. All companies will be small unquoted UK companies that qualify under the EIS tax rules. The Fund is a generalist fund with a tech enabled focus, thereby the sector focus is agnostic and the type of businesses and opportunities can be anything that is EIS compliant (typically small early stage companies in non-capital intensive sectors). The specific focus of the Fund is to target companies with: strong management, momentum in the business (i.e. not pure start-ups) and low risk for a start-up (e.g. have a low cash burn).

For our EIS dealflow Jenson has access to its existing portfolio of SEIS & EIS companies raising follow-on funding.

If I invest now will I be able to claim for 2023/2024 tax year?

The 2023/24 Funds are now closed, however, the 2024/25 SEIS & EIS Funds are open for investment and will be eligible for carry-back relief to the 2023/24 tax year.

When are you closing the fund?

The Funds are evergreen and are tranched with different close dates.

The next close date for our EIS Fund is 28th June 24.

The next close date for our SEIS Fund is 28th June 24.

These close dates are subject to minimum and maximum raises being met.

Who can invest in these schemes?

Participation in the Fund is restricted to individuals who can be categorised as having the expertise, experience and knowledge to make their own investment decisions and to understand the risks involved in relation to the Fund, such characteristics being those of elective professional clients under COBS 3.5.3 R(1),

How will investments be monitored?

Jenson Funding Partners will constantly monitor and re-evaluate the Investments to ensure that they perform to their expectations. This will include regular board meetings, informal meetings with management teams and a review of quarterly financials against budget. Jenson will be working closely with the Investee Companies by providing additional business support services and in some cases a part-time finance director.

How do Investors check the progress of the Fund?

A formal valuation statement prepared by Jenson Funding Partners will be sent to Investors every six months.

Additionally, investors will have access to a portal where they can view their latest valuations, certificates and other documents relating to their investments.

How long will my investment be held in the Fund?

To maximise the growth available to Investors, it is intended that funds will be returned to Investors as each investment is realised. Given the early stage nature of these investments, realisations could take five to seven years.

What is the minimum and maximum I can invest?

SEIS

The minimum participation by an Investor in the Fund under SEIS is £10,000. Participation in excess of this amount must be in multiples of £1,000. There is no maximum participation in the Fund, but income tax relief is presently restricted to a maximum investment of £100,000 under the SEIS and £2million under the EIS respectively. There is no limit on the amount of capital gains tax that can be deferred under SEIS, and no limit on the amount of business property relief for IHT purposes.

EIS

The minimum participation by an Investor in the Fund under EIS is £10,000. Participation in excess of this amount must be in multiples of £1,000. There is no maximum participation in the Fund, but income tax relief and CGT deferral is presently restricted to a maximum investment of £1million per person under the EIS.

Who owns the Investment in the Investee Companies?

The Investors are the beneficial owners of shares in each Investee Company in which the Fund invests. Each Investor’s Investment will be in proportion to his/her investment in the Fund subject only to any rounding where there are insufficient funds to buy a whole share. However, to allow efficient administration, shares will be registered in the name of the Nominee who will hold the shares on an Investor’s behalf as the Investor’s nominee, subject always to HMRC rules for ownership from time to time. Further details of the nominee arrangement are given in Investment Memorandum.

Can an Investor own an investment jointly with his or her spouse?

Investments in the Fund cannot be jointly owned, but each spouse can make a separate investment, and each can receive income tax relief on the first £100,000 in respect of SEIS Qualifying Investments or £1 million in respect of EIS Qualifying Investments but is subject to the limit of the amount of income tax and CGT due to be paid in the tax year by each spouse.